7 Home Improvement Projects That Pay Off When You Sell Your House

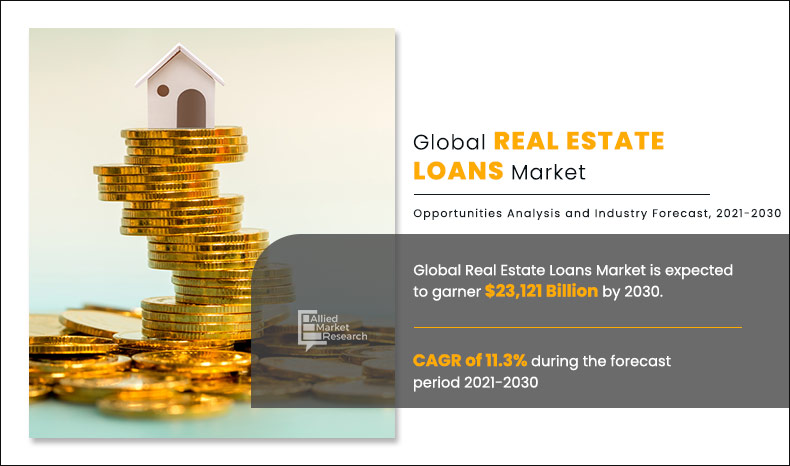

Even in today’s heated real estate market, experts say that giving your house a facelift before listing it may help it sell for more money as long as you choose projects that give you the most bang for your buck. With buyers racing to take advantage of cheap borrowing rates,Read More →