Flash Sale – Up to 25% off until May 10, 2022 – Hurry…

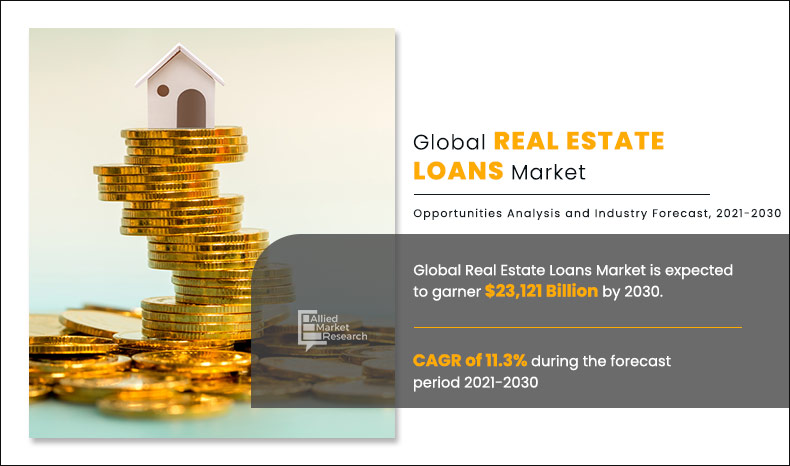

Real Estate Lending Market Stats: Key Factors That Can Increase Global Demand, Business Growth Analysis by Top Countries, Data and Segment Overview

ACCESS FULL REPORT: https://www.alliedmarketresearch.com/real-estate-loans-market-A10048

The market study incorporates an in-depth analysis of the Mortgage Loans Market based on key parameters which consider drivers, sales demands, scope and market share. Additionally, the report provides detailed metrics on drivers, growth, and opportunities that directly influence the market. The report further focuses on assessing the market size of four major regions, namely North America, Europe, Asia-Pacific and LAMEA. The research study is designed to assist readers with a comprehensive assessment of current industry trends and analysis.

The report covers various companies’ home loans research data, benefits, gross margin, global market strategic decisions, etc., through tables, charts, and infographics.

DOWNLOAD FREE SAMPLE REPORT: https://www.alliedmarketresearch.com/request-sample/10413

Other important factors studied in this report include supply and demand dynamics, industrial processes, import and export scenarios, R&D development activities, and cost structures. In addition, consumption supply and demand figures, production cost and selling price of the products are also estimated in this report.

The study will help readers:

1. Recognize complete market dynamics.

2. Inspect the competitive scenario as well as future market landscape with the help of different restrictions such as Porter’s Five Forces and Parent/Peer Market.

3. Understand the impact of government regulations during the Covid-19 pandemic and assess the market throughout the global health crisis.

4. Consider the portfolios of major market players operating in the market coupled with the in-depth study of the products and services they offer.

Main offers:

1. AMR’s report on the Real Estate Lending Market offers an in-depth study of the global market share, key growth determinants, country-level position, segmental assessment, market outlook and main trends.

2. Porter’s five forces model, on the other hand, cites the effectiveness of buyers and sellers, which is important in helping market participants implement successful schemes. In addition, the research study includes,

– Threat of new competitors

– Threat of new replacements

– Bargaining power of suppliers as well as consumers

– Rivalry between key players

3. An explicit analysis of the driving and restraining factors of the global Home Loans Market is also provided in the report.

GET AN EXCLUSIVE DISCOUNT: https://www.alliedmarketresearch.com/purchase-enquiry/10413

Main market players:

The home loan market also focuses on the major players operating in the sector. Their product portfolio, business tactics, company profiles, and revenue share are also neatly defined in the report. Finally, the study describes the strategies such as partnership, expansion, collaboration, joint ventures and others implemented by the forerunners to enhance their status in the sector.

Major market players are changing the vision of the global mortgage lending industry: Bank of America Corporation., JPMorgan Chase & Co., Lendio, Liberty SBF, Northeast Bank, Santander Bank, NA, SmartBiz, The PNC Financial Services Group, Inc. ., US Bank and Wells Fargo.

COVID-19 scenario:

The research study presents the in-depth impact analysis of COVID-19 on the global Home Loan Market. The unprecedented situation has plagued the global economy and the mortgage market has been hit hard, especially during the initial phase. The report also takes into account the details of the scope of the market during this pandemic. In addition, the study provides a large-scale study of the policies and plans executed by key actors throughout this mandate. At the same time, he also cites the post-pandemic scenario, since the majority of government bodies have proposed measures to relax existing rules, while major vaccination campaigns have also been launched across the world. With this drift on board, the global mortgage market should be back on track very soon.

COVID-19/CUSTOMIZATION IMPACT ANALYSIS: https://www.alliedmarketresearch.com/request-for-customization/10413?reqfor=covid

Key market segments:

- BY SUPPLIERS

- BANKS

- NON-BANKING FINANCIAL INSTITUTIONS

- OTHERS

- BY END USER

- BY TYPE OF PROPERTY

- HOTELS

- DETAILS

- INDUSTRIAL

- OFFICE

- RESIDENTIAL

- OTHERS

Most Popular Reports:

1) Contactless payment market

2) Microcredit market

3) Neo and Challenger bank market

Pre-book now with 10% discount:

1) Crowdsourcing market

2) Supply Chain Finance Market

3) Stock market

About Us:

Allied Market Research (AMR) is a full-service market research and business consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global corporations as well as small and medium enterprises with unparalleled quality of “Market Research Reports” and “Business Intelligence Solutions”. AMR has a focused vision to provide business insights and advice to help its clients make strategic business decisions and achieve sustainable growth in their respective market area.